Home » Departments » Tax Assessor

Function

The Assessor maintains the municipality’s assessment roll. This is accomplished by annually updating and valuing the physical components (inventory) of real estate located in a municipality and listing all property values on the assessment roll.

Purpose

The Assessor establishes a base value from which taxes are levied. The tax levy is used to support the local School Districts, County, Town and Special Districts within a municipality. Frequently Asked Questions on the What a Data Collector IS and DOES, can be found by clicking this link

Analysis

The Assessing Office uses three forms of analysis in the valuation of property. On residential property the Cost Analysis and the Market Approach are the two most common forms of valuation used. With commercial or industrial property the Income Analysis is also used.

Assessment

When establishing an assessment for the tax roll, market value is the primary consideration. This is the basis for assessment value, which takes into account an inter-comparison between the assessment of similar properties within the municipality.

The Assessor’s Office is available for information regarding assessments. Taxpayers may examine the information maintained by the assessing office on their own property and review the assessments of other property owners.

The assessor is available for consultation and explanation of the assessment process. There are reporting deadlines that limit the assessor’s ability to change an assessment. The valuation of a property for tax purposes relates to July 1st of the preceding roll year, but the value is based on what improvement exits as of March first each year. March First is known as Taxable Status Day. From the status of inventory that exists as of March 1st, the Assessor prepares the Tentative Roll. The Assessor can make changes on property assessments until the Tentative Roll is published. After that date the Board of Assessment Review must make the roll changes.

The Board of Assessment Review(BAR) is a lay body of citizens who live in the town or municipality. They may or may not have real estate expertise. They meet on the fourth Tuesday of May each year. Their purpose is to listen to the grievances of property owners and possibly make changes in the assessments. Grievances can be filed with the Town Assessor’s Office on or before Grievance Day. The changes that are made by this board are entered on the tentative roll which when complete will be published as the Final Roll. The Final Roll is effective as of the 1st of July.

Individuals who may not be satisfied with the BAR decision can elect to appeal to Small Claims Assessment Review (SCAR). For a fee any residential property’s assessment (with the exception of residential vacant land) can be heard in SCAR. The deadline for filing a petition with SCAR is thirty days of the filing of the Final Assessment Roll, or the public notice of such filing, whichever is later.

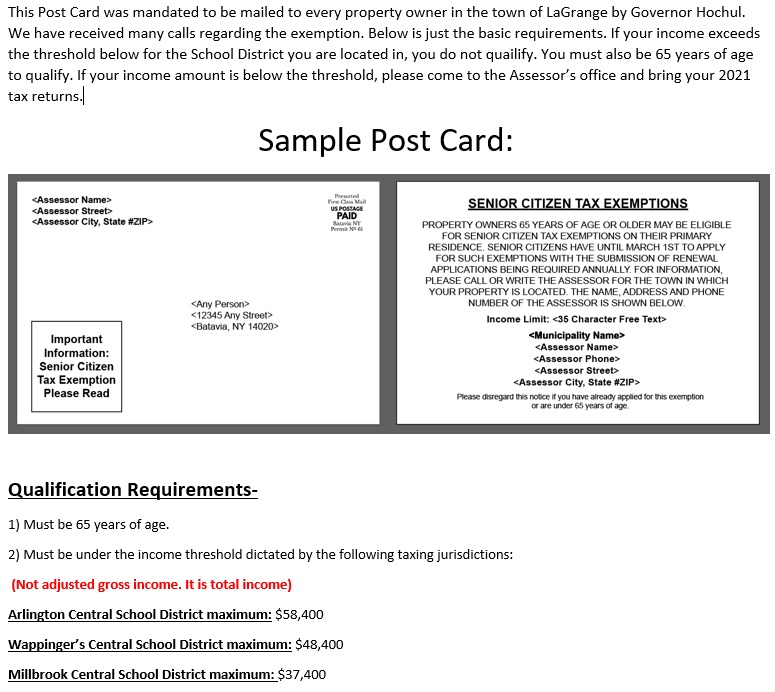

In addition to maintaining the roll, the Assessor processes’ exemptions. The available exemptions include School Tax Relief (STAR) which is available to every homeowner for their primary residence. There are two forms. Basic STAR is available for all residents on their primary residence. Enhanced STAR is available for senior citizens earning less than sixty thousand a year.

Additional exemptions that are provided for eligible homeowners include an Aged Exemption, which is a based on age and income limit. Some individuals with a proven handicap may be eligible for a Disability Exemption. There is a Veterans Exemption for those who served on active duty during wartime. Farmers may be eligible for a partial Agricultural Exemption. Certain organizations may also be eligible for Not for Profit exemptions.

Information About Your Property Taxes:

Dutchess County Property Tax Rolls. When the rolls are available, you will be able to see what your current property taxes are.

- Tax Rolls for Dutchess County Cities, Towns, Villages

- Current Assessment Rolls for Dutchess County Cities, Towns, Villages

Information about your property as filed with the Dutchess County Real Property Tax Service Agency

- Complaints on Real Property Assessments form RP-524

- Instructions to complete the form are RP-524-INS

- The complaint form can be obtained at the NY State site in pdf , or doc format, or as a web fill in form. Instruction are in pdf format.

- Forms and instructions are also available at the Assessor’s Office at the Town Hall.

Detailed information about the assessing process can be found at The New York State Office of Real Property Services (ORPS). For instructions of what to do to file a formal grievance click on What to do if You Disagree With Your Assessment where you will find general information and complete instructions for completing:

- Complaints on Real Property Assessments form RP-524 Instructions to complete the form are RP-524-INS

- The complaint form can be obtained at the NY State site in pdf , or doc format, or as a web fill in form. Instruction are in pdf format.

- Forms and instructions are also available at the Assessor’s Office at the Town Hall.

Robert Taft, Town Assessor

CONTACT

- Robert Taft, Town Assessor

- 120 Stringham Road LaGrangeville, NY 12540

- 845-452-5889

- Fax: 845-452-7692

RESOURCES

New STAR Requirements for 2019

For specifics about the STAR Program and to obtain forms, follow the link below to STAR – School Tax Relief Exemption